佛祖脚下起战火,稀土6000亿、同等关税,这场战争背后的资产洗牌你看懂了吗?

2025年的夏天,并不安静。就在许多人以为全球局势将暂时回稳时,一场发生在东南亚的边境冲突迅速冲上了各国媒体的头条:柬埔寨火箭炮袭击泰国加油站,泰国空军F16战机随即反击,导弹精准打击了柬方的指挥部,整个战事的节奏近乎“电影化”。可这并不是一场意外的火拼——战争像是一根导火索,点燃的并不仅仅是百年前未解的仇恨,更是一张铺开在东南亚大陆上的战略棋盘。

The summer of 2025 is anything but quiet. Just as many believed the global situation might stabilize, a border clash in Southeast Asia dominated headlines: Cambodia launched a rocket attack on a Thai gas station, prompting Thailand’s air force to retaliate with F-16 fighter jets and precision missile strikes on Cambodian command posts. The pace of the conflict was nearly cinematic—but this wasn’t an accidental skirmish. War, in this case, acted as a fuse—igniting not just centuries-old hatred but also revealing a larger strategic chessboard laid out across the Southeast Asian peninsula.

泰柬之间的恩怨确实悠久,但这次之所以突然升级至军事层面,背后有着远比边境争议更大的诱因——美国新一轮关税变化、全球对稀土资源的急切渴望、以及两国国内的政治博弈错综交织。站在地理的交界线,子弹射出之前,很多人没来得及想清楚:这场战争究竟是谁先挑起?更重要的是,谁会成为最终的受益者?谁会因此失去原有的资产秩序?

Indeed, historical animosities between Thailand and Cambodia run deep. But the rapid escalation into military confrontation was driven by far more than border disputes—it’s a tangled knot of U.S. tariff policy changes, global demand for rare earths, and internal political maneuvering in both countries. Standing on this geopolitical fault line, many didn’t have time to ask: who truly started this war? More importantly, who stands to benefit? And who will lose their existing place in the asset order?

◆ ◆ ◆ ◆

边境恩怨,藏着哪些“国耻密码”?

Historical Resentments Conceal “National Shame Codes”

◆ ◆ ◆ ◆

这场冲突表面上看是突发的军事摩擦,实则是一连串历史尘埃被再次揭开的“延时爆炸”。百威夏寺,这座从1907年开始便被殖民者以一纸边界协议撕裂归属的古老寺庙,一直是泰柬两国之间最敏感的领土神经末梢。它的地理结构本身就充满戏剧性——寺庙本体划归柬埔寨,而唯一可通行的通道却落在泰国境内,仿佛一把挂在墙上的宝剑,钥匙却捏在别人手中,怎么可能不引发猜忌与博弈?

On the surface, the conflict appears to be a sudden military clash. In truth, it’s a delayed detonation of unresolved historical grievances. Prasat Preah Vihear, an ancient temple whose territorial ownership was torn apart by colonial-era border agreements in 1907, remains the most sensitive geopolitical nerve between the two nations. Its geographic irony is striking—the temple itself lies within Cambodian territory, but the only access point is on Thai soil. Like a sword hung on the wall with the key in another’s hand, how could that not breed suspicion and contest?

可这场恩怨远不止于地理争执,更是一段关于民族尊严的双向叙事。在柬埔寨的教科书中,吴哥城的失守是“国耻起点”,而在泰国的历史教育里,那却是一场“民族解放”的胜利。这种撕裂式记忆并没有随着时间沉淀而淡化,反而在各自的政局动荡和民族主义情绪中不断被提炼出来,成为政客需要时便可点燃的“政治火把”。

This is not merely a territorial argument—it’s a two-sided story of national pride. Cambodian textbooks describe the fall of Angkor as the beginning of national humiliation. In Thai historical narratives, it is instead portrayed as a triumph of national liberation. These contradictory memories have not softened with time; rather, political turmoil and surging nationalism continue to revive and fuel them, becoming a “political torch” that leaders ignite when convenient.

而当一个寺庙开始承载起国家的尊严、民族的情绪与未来的资源分配时,战争就不再只是军事的事了。它成了一种象征,一种挑明——“谁掌控这里,谁就掌握主动权”。

When a temple begins to carry the weight of national dignity, ethnic sentiment, and future resource allocation, war ceases to be just a military affair—it becomes symbolic. It sends a clear signal: “Whoever controls this place holds the upper hand.”

◆ ◆ ◆ ◆

政治风暴,如何牵出一口稀土金山?

A Political Storm Unearths a Rare Earth Gold Mine

◆ ◆ ◆ ◆

如果说历史是仇恨的引子,那么稀土,才是这场战争真正的催化剂。就在冲突爆发前不久,一份来自地质研究机构的报告悄然流出——泰柬边境地带的地下,隐藏着价值高达6000亿美元的稀土资源。这个数字对于GDP总量不过数百亿美元的柬埔寨,简直像天上掉下的金山;对于已经开始转型升级的泰国来说,更是战略级的“能源芯片”。

If history sparked the conflict, then rare earths were the true accelerant. Not long before the conflict erupted, a geological survey report quietly surfaced, revealing that rare earth deposits worth an estimated $600 billion lie beneath the Thai-Cambodian border. For Cambodia, whose GDP is only a fraction of that figure, it’s a veritable gold mine from the heavens; for Thailand, which is pursuing industrial transformation, it represents a strategic “energy chip.”

稀土是新能源车、武器系统、卫星通信等高科技产业链的关键一环,全球90%集中在中国。而美国近年来频频寻找“非中国稀土来源地”,东南亚自然进入视野。泰国已经是全球电子制造外包重镇,柬埔寨则凭借地价低、劳动力便宜、矿区分布“恰到好处”。 于是,东南亚这个曾经被视为低成本制造基地的区域,被重新审视为可能的“替代方案”。

Rare earths are vital to electric vehicles, weapon systems, satellite communications, and other high-tech industries. China controls 90% of the global supply. The U.S., in its recent search for alternative non-Chinese rare earth sources, has turned its gaze to Southeast Asia. Thailand is already a major hub for outsourced electronics manufacturing, while Cambodia offers low land and labor costs and conveniently located mineral zones. Thus, this region, once seen as a low-cost manufacturing base, is now being reconsidered as a strategic alternative.

在这种背景下,这场战事已经不再是两个小国之间的“佛门之争”,而更像是地缘政治下一轮资源争夺的序章。更复杂的是,美国对泰国“动用F16战机”选择睁一只眼闭一只眼,俄罗斯的矿产公司则频频现身柬埔寨的政商圈。谁在暗中扶持?谁在下注未来?在炮火的间隙里,另一场更大的博弈,正在无声展开。

Against this backdrop, the conflict is no longer just a “temple dispute” between two minor countries. It’s the prologue to a new geopolitical race for resources. Even more complex, the U.S. has turned a blind eye to Thailand’s deployment of F-16s, while Russian mining companies are frequently spotted in Cambodia’s political and business circles. Who is backing whom? Who is betting on the future? In the quiet moments between artillery fire, a larger game is unfolding silently.

◆ ◆ ◆ ◆

降税,不等于利好,是带条件的换牌

Tariff Cuts Don’t Equal Benefits—It’s a Strategic Rebalancing

◆ ◆ ◆ ◆

就在硝烟尚未散尽之时,美国财政部同时宣布:泰国、柬埔寨的商品对等关税统一下调至19%。一时间,两国媒体齐声称赞“迎来转机”,但如果只看数字,就低估了美国这一次在东南亚打出的牌局精妙程度。

As the smoke was still clearing, the U.S. Treasury Department announced that it would uniformly reduce tariffs on Thai and Cambodian goods to 19%. Both nations hailed this as a breakthrough. But anyone only focused on the numbers misses the subtlety of the U.S.’s strategic play.

泰国为换取降税,开出了十张筹码,包括对万项美货零关税、开放东部经济走廊(EEC)、采购波音飞机、五年内削减对美贸易顺差70%等,是一次标准的“结构性换税”,换的是政策信用与产业互通。

Thailand secured its tax cut by offering ten concessions, including zero tariffs on thousands of American goods, opening its Eastern Economic Corridor (EEC), purchasing Boeing aircraft, and pledging to reduce its trade surplus with the U.S. by 70% over five years—a classic case of “structural tariff swap,” trading policy alignment and industrial integration for favorable tax rates.

而柬埔寨这边,则呈现出另一种姿态:在洪马内总理与柬埔寨副總理暨發展理事會CDC高层积极主导下,柬国不但迅速宣布全面取消美货进口关税,还同步启动一项采购计划——向波音公司采购最多20架737 Max型客机,金额高达数十亿美元。更重要的是,柬方在谈判中还明确承认现有检验制度、劳工标准“确实需要改进”,并承诺配合美方进行制度性改革。

Cambodia, on the other hand, took a different route. Under Prime Minister Hun Manet and senior CDC leaders, Cambodia swiftly eliminated import tariffs on U.S. goods and launched a massive purchase plan—committing to buy up to 20 Boeing 737 Max aircraft, worth billions. More importantly, Cambodia openly acknowledged its deficiencies in inspection systems and labor standards, pledging institutional reform in cooperation with the U.S.

换句话说,柬埔寨虽然不像泰国那样已有完整制造配套与供应链地位,但它以“全面迎合+大规模市场换美货”策略,迅速锁定美国在区域内对其的经济政策缓和,甚至在外交语境中上升为“和平调解者”角色——柬埔寨公开感谢川普斡旋停火,并声称“他应获得诺贝尔和平奖”。

In short, while Cambodia lacks Thailand’s robust manufacturing infrastructure, it embraced an “all-in” approach: full market access and large U.S. purchases to gain economic leniency and even a diplomatic upgrade as a “peace mediator”—publicly thanking Trump for brokering a ceasefire and claiming he deserves the Nobel Peace Prize.

美国这一轮同步降税,其实是一手拉住制度型盟友泰国,一手稳住产业型窗口柬埔寨,利用贸易条件精准压制区域紧张,同时为美资企业在该区重构供应链清除障碍。

This round of simultaneous tariff cuts was the U.S. pulling Thailand in as a systemic ally, while stabilizing Cambodia as a tactical industry outpost—using trade conditions to defuse regional tension while clearing the path for American firms to restructure supply chains.

从投资视角来看,这种“降税不等于红利”的局面意味着:税率一致不代表地位对等,谁能提供长期制度信用,谁才是真正的战略型对象。柬埔寨虽然抢下短期市场红利,但泰国获得的,是中长期经济架构重塑中的“入场卷”。

rom an investment perspective, this shows that “lower tariffs ≠ direct gain.” Equal tax rates don’t mean equal status—whoever offers lasting institutional trust becomes the true strategic partner. Cambodia may reap short-term gains, but Thailand has secured an entry ticket into the next phase of industrial realignment.

◆ ◆ ◆ ◆

资产配置与企业出海布局:该怎么选?

Asset Allocation & Overseas Strategy—What Should You Choose?

◆ ◆ ◆ ◆

随着地缘不确定性升温与全球政策博弈交错,东南亚对外资来说,早已不再是“复制一个中国”的乐土,而更像是两种截然不同的投资路径图。战争之后的东南亚,正以“资产配置的分化赛道”与“出海战略的双重选题”呈现在投资者面前。

As geopolitical uncertainty rises and global policy tensions increase, Southeast Asia is no longer a playground for duplicating “China 2.0.” Instead, it’s split into two very different investment paths.

泰国:制度绑定下的“稳定增值型”资产地带

Thailand: A Stable Asset Zone for Long-Term Value Growth

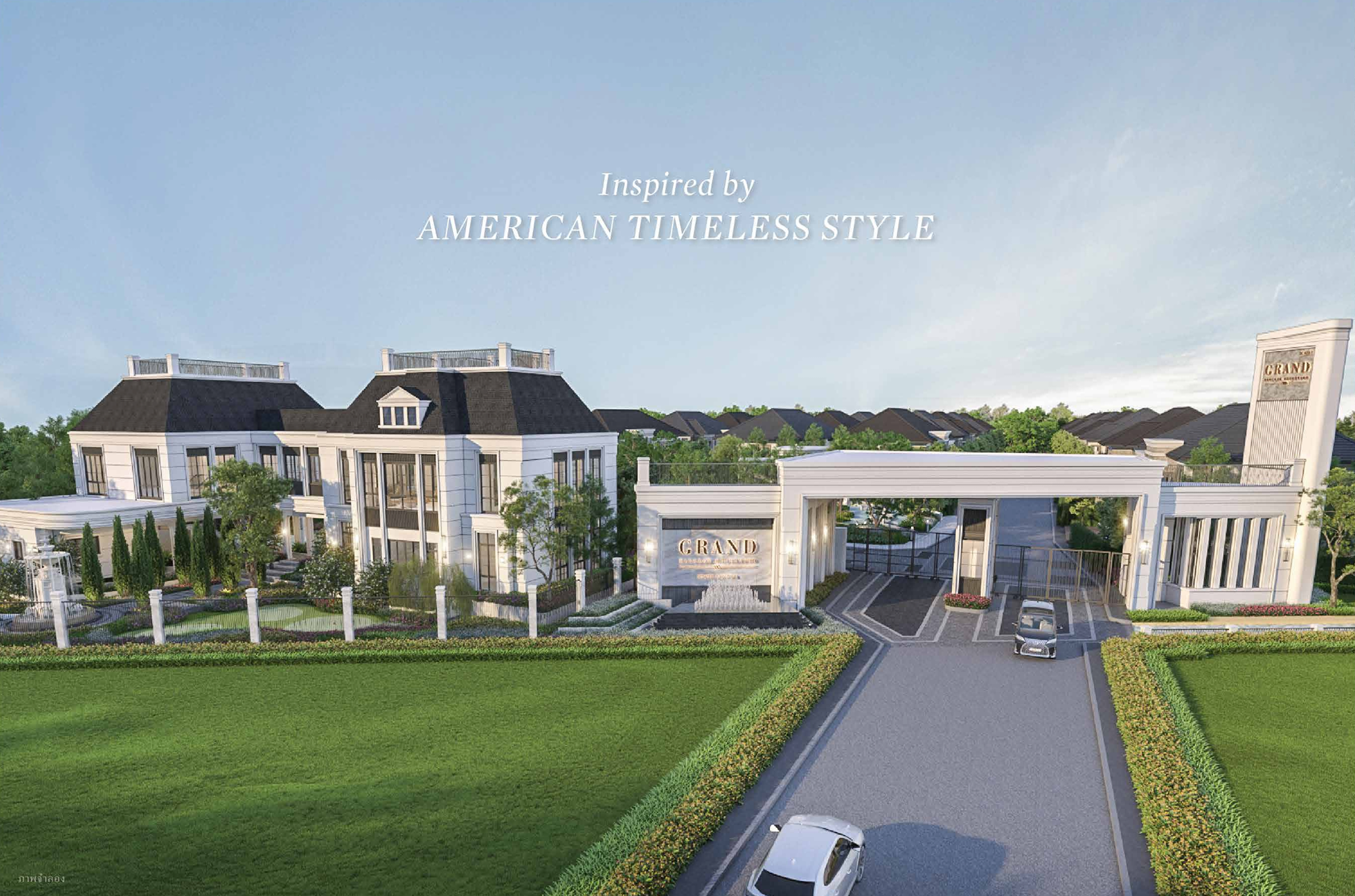

泰国拥有:成熟的法律制度;多年累积的外资友好政策;与日本、美国、欧盟等长期产能合作基础。这使得泰国的房地产资产具有强抗风险属性,适合中长期持有,尤其在曼谷、清迈、普吉这类城市,具备稳定的旅游、医疗、教育三重刚需租赁市场,加之房产产权清晰、外资购置政策透明,使其在动荡环境中依旧被视为“避险型不动产”。

Thailand boasts: mature legal systems, a long-standing track record of foreign investment friendliness, and established industrial ties with Japan, the U.S., and the EU. This makes Thai real estate a resilient asset class for mid-to-long-term holding—especially in Bangkok, Chiang Mai, and Phuket—where stable demand from tourism, healthcare, and education supports the rental market. With clear property rights and transparent foreign ownership policies, Thailand remains a “safe haven” even amid volatility.

而在政策层面,泰国与美方达成的结构性让步换来了制度信用背书,未来极可能吸引更多国际制造业、科技服务与物流基础设施落地。也就是说,不仅是房子,配套产业也将托起长期资产增值的支撑面。

On a policy level, Thailand’s structural concessions to the U.S. have earned institutional credibility. It’s likely to attract more international manufacturing, tech services, and infrastructure investments. That means not just property—but surrounding industries—will support long-term asset appreciation.

适合人群:风险偏好低、注重资产安全、追求稳健回报的中产以上投资者;寻求供应链闭环与制度协同的中大型制造/服务类企业。

Ideal for: Investors with low risk appetite, seeking asset safety and stable returns; mid-to-large enterprises seeking supply chain integration and policy alignment.

柬埔寨:窗口机会下的“高波动套利型”资产场域

Cambodia: A High-Volatility, High-Arbitrage Investment Arena

柬埔寨的投资逻辑几乎完全相反,它是典型的政策红利型市场。虽然其基础建设、法制透明度、货币风险控制能力远不如泰国,但其优势在于:超低的土地成本与劳动力成本;美元计价、对外资极度宽松的购置与汇出机制;金边、暹粒等地尚处于发展初期阶段,成长弹性巨大。

Cambodia’s investment logic is the opposite—it’s a policy-windfall-driven market. While its infrastructure, legal transparency, and currency stability lag behind Thailand, it excels in ultra-low land and labor costs, USD-denominated markets, and extremely liberal property and capital repatriation policies. Cities like Phnom Penh and Siem Reap are still in early-stage development, offering significant upside potential.

2025年美国下调对柬关税、并未设置复杂附加条款,这说明美国更多将其视为“应急式供应链落点”与“战术转单中继站”,这种窗口期虽短,但机会极高。尤其是中资背景的出海企业,已大规模在柬设立生产基地、轻工业配套设施,这反过来也带动了工业园区周边的居住型资产、员工租赁市场活跃。

The 2025 U.S. tariff cuts, with minimal strings attached, signal Cambodia’s role as a “tactical supply chain node” and a short-term relay point. Though the window is brief, the opportunity is real. Chinese enterprises have already set up manufacturing bases and light industry parks in Cambodia, driving demand for surrounding residential and worker rental markets.

适合人群:风险容忍度高、希望在短期市场窗口中套利的人群;中小型轻资产出海企业或电商、服装、代工类转移型工厂。

Ideal for: High-risk-tolerant investors looking to capitalize on short-term market windows; SMEs or light-asset companies in e-commerce, apparel, or manufacturing shifting offshore.

◆ ◆ ◆ ◆

真正的机会,在风暴退去后

True Opportunities Arise After the Storm Subsides

◆ ◆ ◆ ◆

战争、稀土、关税、谈判、投资,表面是冲突,实则是一次资产秩序的重构。这场东南亚动荡的背后,早已不只是两国之争,而是一次全球产业链与政治博弈的剧本彩排。

War, rare earths, tariffs, negotiations, investment—it all seems like conflict, but in truth, it’s a restructuring of the global asset order. This Southeast Asian upheaval is no longer a bilateral dispute, but a global rehearsal of industrial and geopolitical realignment.

投资的机会,不在战火中心,而在风暴背后。

Investment opportunities aren’t found in the heart of conflict, but in its aftermath.

你看到的是一场边境冲突;但你要读懂的,是下一阶段东南亚资产的重新标价逻辑。谁先明白局势不是涨跌决定,而是结构决定,谁就能在风暴散去之后,还能站着。

You may see a border clash.But what you must understand is the re-pricing logic of Southeast Asian assets.Those who realize that structure, not fluctuation, determines outcomes—will still be standing when the storm clears.