冷热交错的2025,泰国房地产走到十字路口

◆ ◆ ◆ ◆

为什么说2025是泰国地产“分水岭”?

Why is 2025 a watershed moment for Thai real estate?

◆ ◆ ◆ ◆

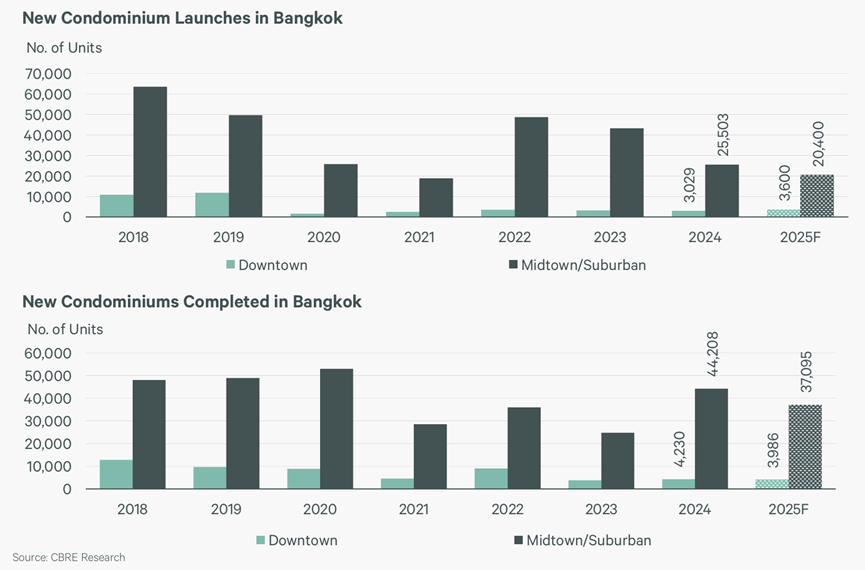

2025年,对泰国房地产市场来说,是一场“冷暖交错”的临界点。公寓项目的供应量滑落到四年来最低,开发商不再盲目上新,转而聚焦库存和品质;而旅游、制造、物流等产业的快速复苏,却给酒店和工业地产注入了新的热量。从曼谷CBD写字楼搬迁潮,到二手别墅的逆袭,再到外资抢地的工业园区,这一年每个赛道的变化都不再同步,有的在收缩,有的在狂飙。

For Thailand's property market, 2025 marks a turning point where hot and cold trends intersect. The number of new condominium projects has fallen to its lowest level in four years. Developers are no longer aggressively launching projects, instead focusing on inventory and quality. Meanwhile, the rapid recovery of tourism, manufacturing, and logistics has reignited interest in hotel and industrial real estate. From the wave of office relocations in Bangkok's CBD to the resurgence of the second-hand villa market and the land-grabbing by foreign investors in industrial parks, every segment of the market is moving at a different pace—some are contracting, others are booming.

这种冷热并存、节奏断裂的走势,也打破了过去“全线走强或全线疲软”的周期性规律。如果说过去几年是疫情阴影下的震荡缓冲,那2025,很可能才是决定方向的转折点。

This divergence breaks the previous cyclical pattern of the entire market rising or falling together. If the past few years were a period of turbulence under the shadow of the pandemic, 2025 may very well be the real turning point in determining the future direction.

◆ ◆ ◆ ◆

市中心楼盘稀缺,外资买家又回来了

Downtown Supply Becomes Scarce as Foreign Buyers Return

◆ ◆ ◆ ◆

如果说前几年泰国楼市是靠“量”堆起来的,那么现在的方向已经悄然改变:精致、高价、稀缺,成了市中心公寓的新关键词。2025年,开发商在市中心推新动作频繁,房源却变少了,户型更大,装修更讲究,不再打低价牌,而是瞄准了愿意长期持有的中产家庭与外籍投资客。

If the Thai housing market in recent years was driven by volume, its current focus has quietly shifted: refined, high-priced, and rare properties have become the new keywords for downtown condominiums. In 2025, while developers are actively launching new projects in the city center, the number of available units has dropped. Apartments are larger and more carefully decorated. Gone are the days of price wars—now, the target buyers are middle-class families and foreign investors willing to hold properties long-term.

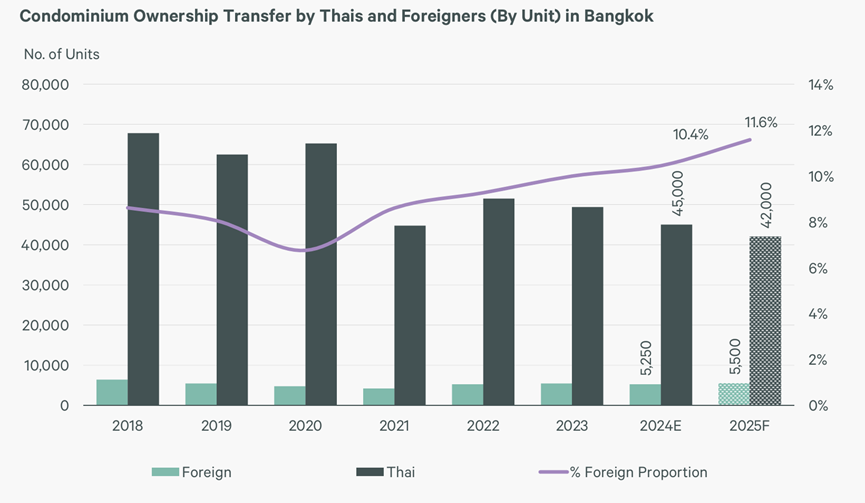

而随着旅游恢复、签证放宽、区域安全感回升,中国、台湾、东南亚买家正在重返市场,尤其对曼谷核心地段的兴趣明显回暖。虽然整体外资占比仍低,但购买力强、成交快的特点,让他们成为当前最“优质”的客户群体。对开发商来说,比拼的已经不是谁出的楼多,而是谁能在核心区抢下最挑剔的客户。

With tourism rebounding, visa policies relaxing, and regional stability improving, buyers from China, Taiwan, and Southeast Asia are returning to the market, especially showing renewed interest in Bangkok’s prime locations. Although the overall share of foreign buyers remains relatively small, their strong purchasing power and quick decision-making make them the most "valuable" clientele. For developers, the competition is no longer about who builds more units, but who captures the most discerning buyers in the city’s core.

◆ ◆ ◆ ◆

房子越贵越不好卖?高端市场遇瓶颈

Are Expensive Homes Harder to Sell?

The Luxury Segment Hits a Ceiling

◆ ◆ ◆ ◆

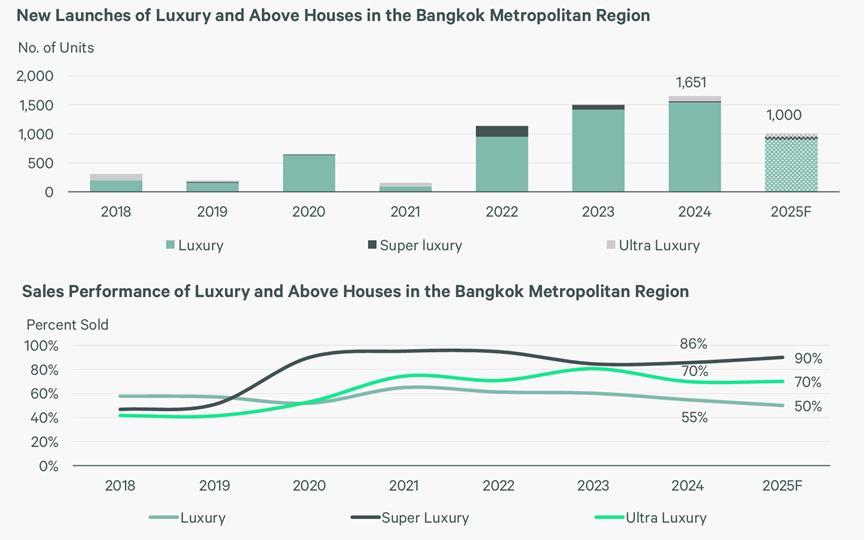

过去三年,高端住宅在泰国一直风头正劲。无论是售价上千万泰铢的独栋别墅,还是定位“超级豪宅”的城市豪宅项目,都能快速出清,仿佛经济低迷与他们无关。但到了2025年,这股热潮逐渐冷却。那些已经在前几年完成置业的富裕家庭开始“观望”,而真正愿意买下第二套甚至第三套豪宅的人,也越来越少。

Over the past three years, high-end housing in Thailand has been a star performer. Whether it's single-family villas priced in the tens of millions of baht or ultra-luxury urban residences, properties sold out rapidly—as if the sluggish economy didn’t apply. But in 2025, the enthusiasm has begun to cool. Wealthy families who already bought homes in recent years are now more cautious, and there are fewer buyers seeking to acquire a second or third luxury property.

更明显的是开发商的策略变化:不少原本打算再推出顶奢产品的企业,开始转向“高端但不奢侈”的中价带,集中发力在1500万到3000万泰铢之间的产品区间。这一市场既能满足品质住宅需求,又避开了超高端市场“卖不动”的困局。换句话说,2025年,是高端市场“拐点”的一年,房子贵,并不再是卖得好的理由。

This shift is evident in developers’ changing strategies. Many who originally planned to launch ultra-luxury projects are now pivoting to a “high-end but not extravagant” mid-price range, focusing on units priced between 15 and 30 million baht. This segment satisfies demand for quality living while avoiding the “unsellable” dilemma of the ultra-premium market. In short, 2025 is the turning point for the luxury segment—high prices are no longer enough to guarantee sales.

◆ ◆ ◆ ◆

一线写字楼逆势涨租,企业搬家趋势明显

Top-Grade Offices Defy the Trend, Relocations Gain Momentum

◆ ◆ ◆ ◆

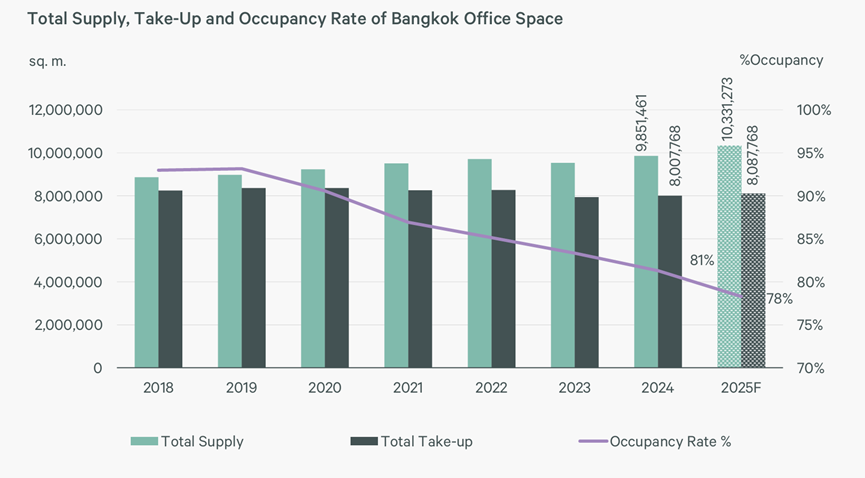

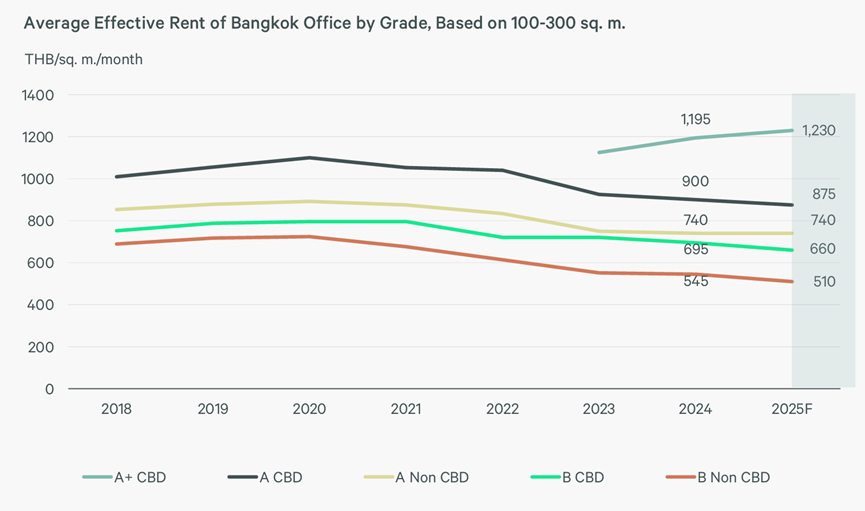

在居住类市场陷入“量缩价稳”时,曼谷写字楼却呈现出另一种节奏:新楼盘频频亮相,企业搬迁潮也随之而来。2025年,新建高等级写字楼集中入市,不仅硬件更现代,位置也更靠近交通枢纽,吸引了大量大型公司“脱离老旧办公楼”,搬进设施更新的空间。

While the residential market experiences a “shrinking volume with stable prices,” Bangkok’s office market is playing by different rules. New high-grade office buildings are being launched frequently in 2025, triggering a wave of corporate relocations. These new buildings offer modern amenities and are located closer to transit hubs, attracting large companies to upgrade from outdated office spaces.

CBRE数据显示,去年93%的搬迁企业都选择了“升级或平级”空间,说明“更好”比“更便宜”更重要。这波“以质换量”的趋势,还带来了租金结构的分化——顶级A+级写字楼租金逆势上涨,而中低端写字楼则不得不靠折扣和灵活租期挽留租户。到了2025年,写字楼不再只是空间,更是企业展示形象与吸引人才的战略资源。

According to CBRE, 93% of relocating firms in the past year moved into equal or better-quality spaces, highlighting that “better” is more important than “cheaper.” This trend of upgrading has led to rental price divergence: rents for top-tier A+ buildings are rising against the odds, while mid- and low-end buildings must offer discounts and flexible lease terms to retain tenants. In 2025, office buildings are no longer just workspaces—they have become strategic tools for branding and talent acquisition.

◆ ◆ ◆ ◆

旅游复苏带旺商场与酒店,能持续多久?

Tourism Revival Boosts Malls and Hotels—But for How Long?

◆ ◆ ◆ ◆

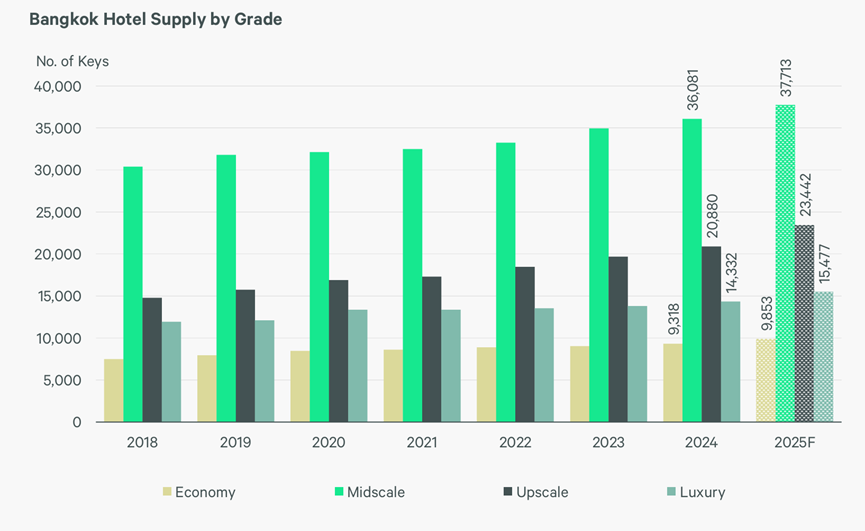

走进曼谷的商场,你会发现熟悉的“热闹”又回来了。2024年下半年,泰国游客大幅反弹,不仅让零售业回温,也带火了中高端酒店与大型购物中心,特别是那些位于市中心、接轨地铁与景点的“封闭式购物中心”,出租率迅速回升。2025年,预计入境游客将达到疫前高点,官方目标高达4000万人次,消费信心也随之逐步修复。

Strolling through Bangkok's shopping malls, you'll notice the familiar buzz is back. In the second half of 2024, tourist numbers rebounded sharply, reigniting the retail sector and boosting demand for mid-to-high-end hotels and large shopping centers. This is especially true for enclosed malls in central locations connected to metro lines and attractions, where occupancy has quickly recovered. In 2025, Thailand expects to welcome as many as 40 million visitors, nearing pre-pandemic levels, bringing back consumer confidence along with them

但热度归热度,背后的隐忧也不容忽视。新商场、新酒店的入市节奏也在加快,特别是在高端酒店领域,2025年将有超过5500个新增客房,多集中在房价4000泰铢以上的区间。这意味着,游客增长的蛋糕虽大,却可能不够分。入住率和平均房价将受到挤压,留给中等规模运营商的生存空间,可能会越来越逼仄。

However, despite the current boom, there are concerns beneath the surface. The pace of new mall and hotel openings is accelerating—particularly in the high-end hotel sector, with over 5,500 new rooms expected in 2025, mostly priced above 4,000 baht per night. This means that while the tourist pie may be growing, it may not be big enough for everyone. Occupancy rates and average room prices could come under pressure, and medium-sized operators might find it increasingly difficult to survive.

◆ ◆ ◆ ◆

外资争抢工业地,制造业正悄悄迁移中

Foreign Capital Races for Industrial Land as Manufacturing Quietly Shifts

◆ ◆ ◆ ◆

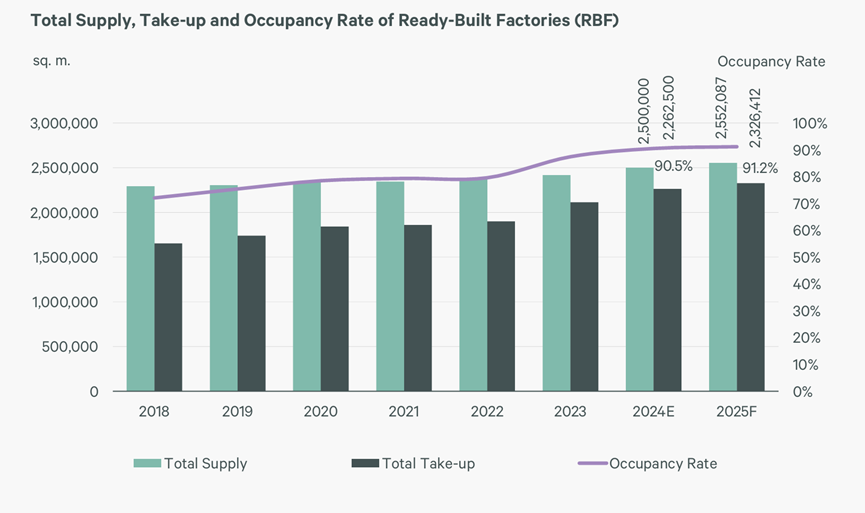

与低迷的住宅市场相比,泰国的工业地产业在2025年显得格外“热”。得益于全球制造供应链重组、电动车和电子零部件行业的崛起,以及东南亚制造中心地位的强化,外资企业正大举进入泰国。特别是在WHA与Amata等重点工业园区,土地成交量持续高位,东部经济走廊(EEC)成了外企争抢的主战场。

Compared to the sluggish housing market, Thailand’s industrial real estate sector is heating up in 2025. Benefiting from the global restructuring of manufacturing supply chains, the rise of EVs and electronic components, and Southeast Asia’s growing status as a manufacturing hub, foreign companies are pouring into Thailand. Key industrial parks like WHA and Amata continue to see strong land sales, with the Eastern Economic Corridor (EEC) emerging as a prime battlefield for foreign investment.

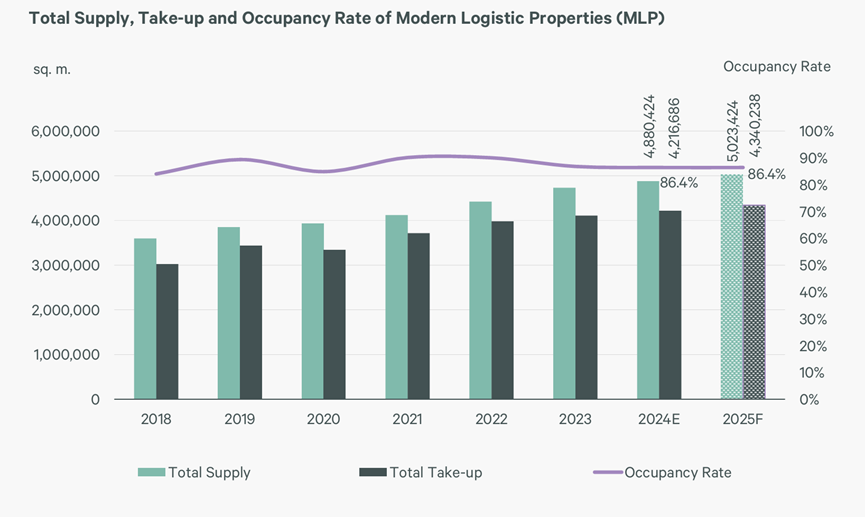

不仅如此,标准化厂房(RBF)和现代物流仓储(MLP)也跟着水涨船高。在Chonburi和Rayong,部分旧仓库被快速改造成新厂房,以满足EV产业链对“拎包即产”的空间需求。虽然全球仍存不确定性,比如贸易保护主义与地缘政治风险,但正因为这些变量,不少企业反而加快了“去中国化”或“东南亚布局”的步伐。换句话说,泰国工业地产已经从“选项”变成了“优先选项”。

Standard factories (RBF) and modern logistics properties (MLP) are also thriving. In Chonburi and Rayong, some older warehouses are being swiftly converted into new factories to meet the “plug-and-play” demands of the EV supply chain. Despite lingering uncertainties like trade protectionism and geopolitical risks, these variables are pushing many firms to accelerate their “China+1” or Southeast Asia strategies. In other words, Thailand's industrial real estate has moved from being a "choice" to a "priority."

当住宅遇冷、办公升级、商场复苏、酒店扩容、工业腾飞,这些原本属于不同轨道的赛道,在2025年的泰国楼市交汇出一幅“冷热交错”的复杂图景。对投资者、开发商、品牌、甚至政府而言,这不再是单纯的周期波动,而是一次结构性的重组与方向性选择。

As Residential Cools, Offices Upgrade, Malls Recover, Hotels Expand, and Industry Booms. These once separate tracks of Thailand's real estate market converge into a complex landscape of contrasts in 2025. For investors, developers, brands, and even the government, this is no longer about riding the waves of the cycle—it's about structural shifts and directional choices.

楼市不是一场比快的游戏,而是一次比判断力、资源整合和长期策略的耐力赛。有人退出,有人观望,也有人趁机布局。而每一次“分水岭”,最终都会告诉我们——谁才是真正看清大势的人。

The property market is not a race of speed, but a marathon of judgment, resource integration, and long-term strategy. Some will exit, others will wait and see, while a few will seize the opportunity to build their positions. And every “watershed moment” will eventually reveal—who truly understood the big picture.