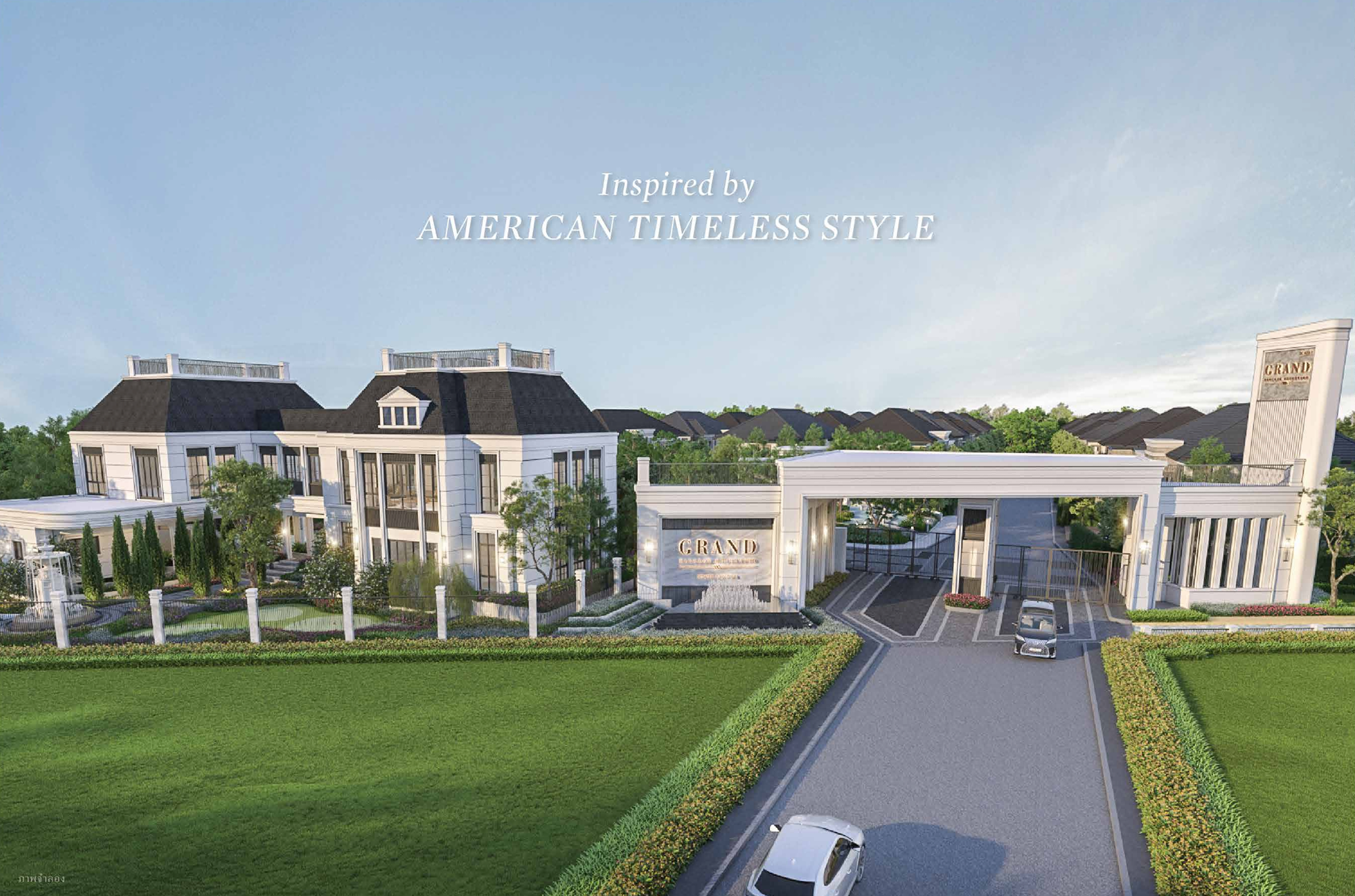

Z世代正在“掀桌子”:不买房、不贷款,投资人赚翻了租赁回报高达 4-9%

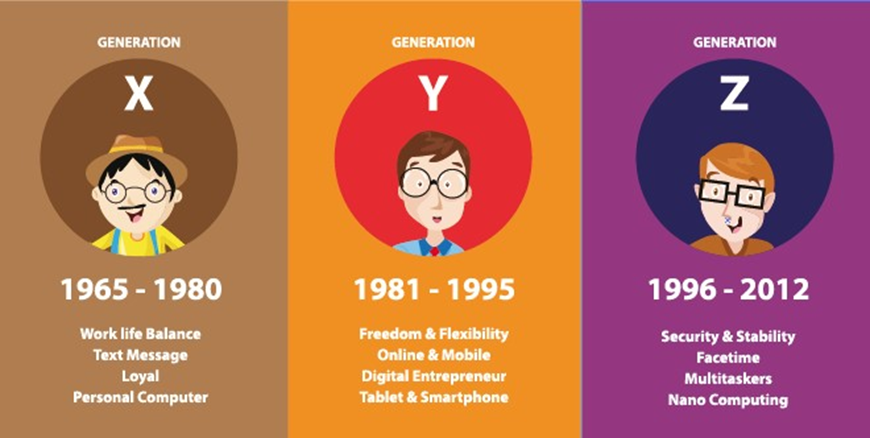

在泰国,如今一场安静却深远的变革,正悄悄发生在房地产市场。越来越多的Z世代和Y世代青年,正在放弃传统的“买房安家”路径,选择灵活自由的租房生活。

In Thailand, a quiet revolution is reshaping the real estate landscape. More and more members of Gen Z and Gen Y are turning away from the traditional dream of owning a home. Instead, they’re embracing a lifestyle defined by mobility, freedom, and choice.

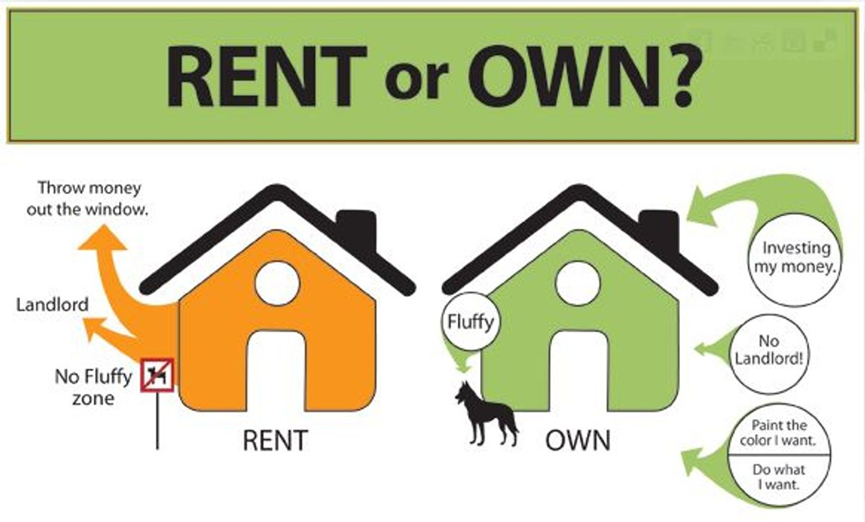

LWS Wisdom and Solutions的一项调研显示,超过66%的年轻人明确表示倾向租房,而不是购置物业。这一数字的背后,预示着泰国房地产的结构性转向——从“刚需自住”走向“灵活租赁”,一场由年轻人主导的新生活模式正在悄然登场。

A survey by LWS Wisdom and Solutions reveals that over 66% of young adults now prefer renting over buying property — a clear sign of a generational pivot. What was once a market centered around ownership is evolving into one shaped by flexibility, convenience, and curated experiences. A new way of living is taking root — and it’s driven by youth.

◆ ◆ ◆ ◆

为什么更爱租

Why Renters Are Taking Over

◆ ◆ ◆ ◆

为什么年轻人不再执着于“有房才安心”?答案或许藏在他们不断变动的生活轨迹里。Z世代和Y世代大多成长在一个节奏飞快、变数极多的时代,跳槽、换城市、换赛道,已成为常态。相比动辄数十年的贷款绑定,他们更在意生活的灵活度。租房意味着可以随时选择离开,也不必背上沉重的债务包袱。

For today’s younger generation, stability doesn’t come from a mortgage. It comes from the freedom to move, explore, and adapt. Raised in an era of rapid change, frequent job-hopping, and global mobility, Gen Z and Y place a premium on flexibility. Renting frees them from long-term financial commitments and allows them to pivot quickly.

数据显示,这批年轻租户大多数是单身女性,每月租金预算集中在5,000至10,000泰铢之间,选房标准也从“面积”转向“便利”“设计感”“公共设施”和“交通便利”等关键词。与其说他们是在凑合,不如说是在主动筛选更适合自己的生活方式。

Most are single women with monthly rental budgets between 5,000 and 10,000 baht. But their focus isn’t on space — it’s on design, convenience, shared amenities, and access to transit. They're not settling; they’re choosing a lifestyle that fits who they are.

◆ ◆ ◆ ◆

投资人看到了啥

Investors See Opportunity Where Others See Risk

◆ ◆ ◆ ◆

年轻人放弃买房,听上去像是市场的“利空”,可聪明的投资人却早已嗅到机会的味道。租房需求的飙升,让“买房出租”成为一门越来越划算的生意。

At first glance, the shift away from ownership may seem like bad news for the property market. But sharp investors see the opposite: opportunity. As demand for rentals surges, buy-to-let investments are proving more lucrative than ever.

LWS首席执行官Praphansak指出,如今投资出租房产的回报率可达4%至9%,在股市动荡、银行利率低迷的大环境下,这种稳定收益显得尤为可贵。

According to LWS CEO Praphansak, rental yields now range from 4% to 9% — a rare beacon of stability in today’s volatile financial landscape.

尤其是那些售价在100万至200万泰铢之间的小户型公寓,每月能稳定带来5,000到10,000泰铢的租金,不仅回本周期清晰,还具备抗风险能力。在“自住属性”让位于“现金流价值”之后,房地产,也许正迎来一场角色的重塑。

Compact condos priced between 1 to 2 million baht are bringing in consistent monthly rents of 5,000 to 10,000 baht, with clear ROI timelines and strong risk resistance. Real estate is being reimagined — no longer just a place to live, but a reliable cash-flow asset.

◆ ◆ ◆ ◆

开发商也转弯

Developers Are Selling Lifestyles, Not Just Homes

◆ ◆ ◆ ◆

当租房成为主流选择,房地产开发商自然也不能再墨守成规。他们开始抛弃过去“只卖不租”的单一路线,转而推出更多灵活的租赁解决方案。像“先租后买”计划就极具吸引力——年轻人可以先以租户身份试住,未来再决定是否购入。

As the market shifts, developers are pivoting fast. Gone are the days of “sell-only” strategies. Today’s offerings include flexible leasing plans tailored to modern lifestyles. Rent-to-own schemes let young people test the waters before buying.

而针对频繁搬家的上班族,“多地点固定价格租赁”也成为新宠,一份合同可以覆盖多个小区,自由切换居住地点。此外,还有打包的服务式租赁产品:从搬家协助、定期清洁到故障维修,一应俱全,真正做到拎包入住。面对这一波生活方式的转型,开发商的反应不再是焦虑,而是主动拥抱变化,把“卖房”变成“卖生活方案”。

Fixed-price, multi-location leasing allows mobile professionals to hop between neighborhoods under a single contract. Full-service rental packages include everything from move-in help to regular cleaning and maintenance. Developers aren’t resisting change — they’re leaning in, shifting from selling property to delivering living solutions.

◆ ◆ ◆ ◆

海外投资者也能上车

Foreign Investors Are Getting in the Game

◆ ◆ ◆ ◆

面对这波以租代买的趋势,眼光敏锐的海外投资者也开始纷纷入场。相比高门槛的商业地产或整栋公寓投资,如今只需购买一两套小户型,就能轻松布局泰国的租赁市场。许多开发商还提供一站式的托管服务,代为寻找租客、签署合同、日常维护,甚至承诺保底收益。

Global investors are taking notice too. Compared to high-barrier commercial investments, buying just one or two units offers an easy entry point into Thailand’s booming rental market. Many developers now provide turnkey management — handling everything from finding tenants to guaranteeing minimum returns.

对于希望以较低成本参与亚洲房产配置的海外资金来说,这种“轻投资、高效率、低风险”的模式极具吸引力。在全球经济动荡与利率波动频繁的当下,租赁型物业正成为一种更稳健的国际资产选项。

For overseas buyers seeking low-cost, low-risk access to Asian real estate, this model offers unmatched efficiency and appeal. Amid global economic uncertainty, rental property is becoming a stable and attractive international asset.

年轻人不再一头扎进“买房保值”的传统观念,而是用脚步丈量城市,用选择定义生活。这背后,不只是生活方式的变化,更是价值观的一次更新。而对于嗅觉敏锐的投资者来说,这场变革既是挑战,也是绝佳的窗口期——租赁市场的黄金时代,或许才刚刚开始。

This isn’t just about housing — it’s about values. Young people are rewriting the rules. They’re not chasing homeownership as a badge of success; they’re curating lives full of choice, movement, and self-definition. This cultural shift signals more than a trend — it marks the beginning of a rental market renaissance. And for those who recognize it early, the golden age of leasing may just be getting started.