Bangkok’s Serviced Apartments Soar—One-Bedroom Rents Hit 100,000 Baht as Prime Locations Heat Up

◆ ◆ ◆ ◆

曼谷服务式公寓是下一个“掘金地”

Serviced Apartments in Bangkok Are Becoming the Next Goldmine

◆ ◆ ◆ ◆

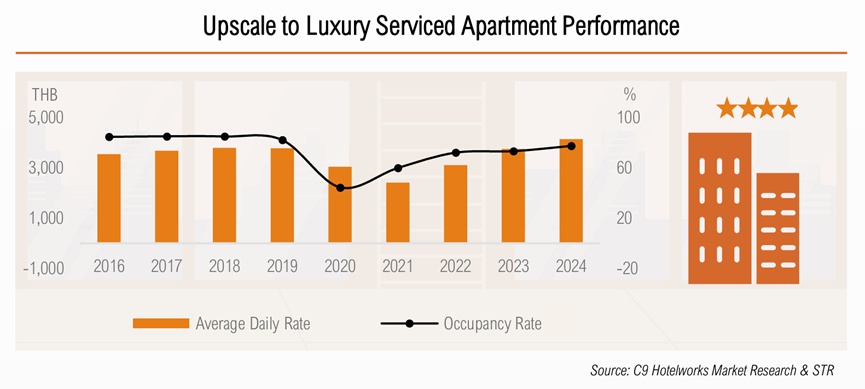

近几年,一股投资热潮正悄然在东南亚升温,而曼谷,无疑是风口上的那个城市。根据C9 Hotelworks的最新数据,曼谷服务式公寓市场过去十年保持了年均6.2%的稳定增长,这在疫情后的全球房地产版图中尤为亮眼。

Southeast Asia has quietly become a magnet for real estate investment—and at the heart of it lies Bangkok. According to the latest data from C9 Hotelworks, the city’s serviced apartment market has achieved an impressive average annual growth rate of 6.2% over the past decade, standing out in a global market still recovering from the pandemic.

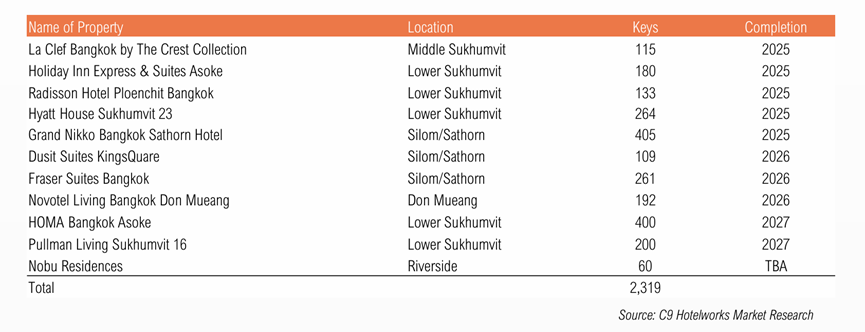

推动这一趋势的,除了旅游业的全面复苏,还有国际连锁品牌的持续入驻——从万豪、雅诗阁,到本地强势运营商如Chatrium、Centre Point,一波又一波的资本与品牌纷纷下注这片市场。21,500多套现有房源、超2300套即将入市的新供应,不仅拉高了整个城市的租住水准,也让这个本地人口密集、游客回流迅猛的城市,再次成为亚洲投资者眼中的香饽饽。

This surge isn’t just fueled by a tourism comeback. It's the result of a steady influx of global hotel brands—from Marriott and Ascott to strong local names like Chatrium and Centre Point—all staking their claim in Bangkok. With over 21,500 existing serviced units and another 2,300 soon to launch, the city’s rental standards are on the rise. The result? A densely populated metropolis that’s once again topping the list for Asian real estate investors.

◆ ◆ ◆ ◆

谁在住?谁在投?藏着怎样的逻辑

Who’s Renting? Who’s Buying?

The New Logic Behind the Demand

◆ ◆ ◆ ◆

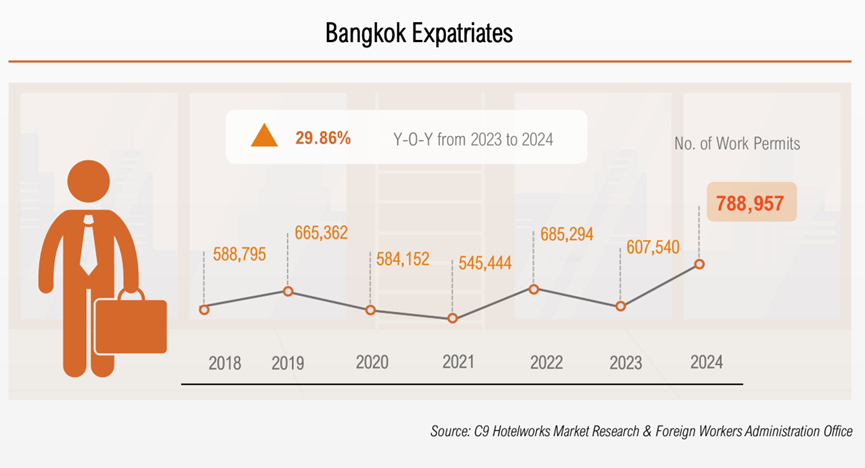

如今在曼谷,选择服务式公寓的人,已经悄悄换了主角。曾几何时,这里是日企派驻员工的常驻地,尤其是Sukhumvit沿线的日式公寓,几乎成了“东瀛小镇”。但随着企业逐步缩减外派补贴,长期合约的需求明显萎缩,取而代之的是“短租+灵活”的租住趋势。

The tenant profile in Bangkok’s serviced apartments has shifted. Gone are the days when they primarily housed Japanese expats with long-term corporate contracts. With companies tightening housing budgets, the city is now seeing a wave of short-term, flexible leases replace traditional long-term stays.

现在的住户,更像是一群流动的中产群体:他们来自中国、日本、韩国、印度,甚至欧洲、中东;停留时间少于一个月,却愿意为“一间像家的房子”多付一些费用。洗衣机、简易厨房、日常清洁服务——这些酒店做不到的配套,成了他们选择服务式公寓的理由。

Today’s renters are mobile professionals—middle-class travelers from China, Japan, South Korea, India, Europe, and the Middle East. Most stay for less than a month, yet they’re willing to pay more for a place that feels like home. The appeal? In-unit laundry, compact kitchens, and regular cleaning services—essentials that hotels often lack.

而在这一趋势背后,不少买家早已看清其中商机,开始以“投资+运营”双轨并行的方式切入市场:出租给短租旅客,收租比传统长租高出一截,又比Airbnb更稳定。

Investors have quickly caught on. Many are pursuing a dual strategy: buying and managing units to rent out short-term. These rentals yield higher returns than conventional long leases and offer greater stability than Airbnb.

◆ ◆ ◆ ◆

Sukhumvit火成什么样?看地图和数据

Sukhumvit: The Beating Heart of Bangkok’s Rental Market

◆ ◆ ◆ ◆

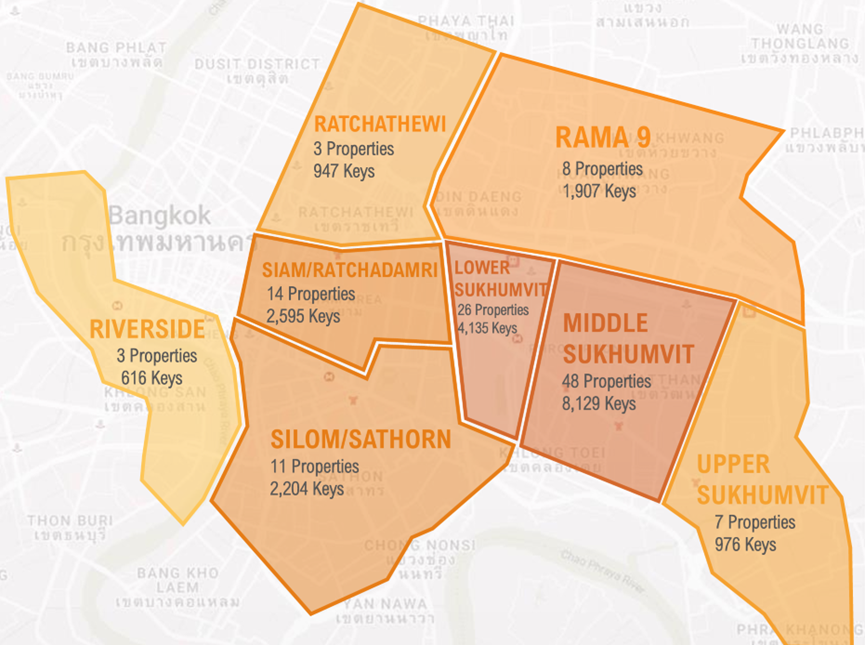

在曼谷,服务式公寓的密度并不均匀,而是高度集中在一个地方——Sukhumvit。这条贯穿城市中轴的主干线,已成为高端生活与国际租客的代名词。数据显示,中段Sukhumvit(Phrom Phong至Ekkamai)聚集了多达48个项目、8129套房源,是整个城市供应量最多的区域。

Bangkok’s serviced apartments aren’t scattered—they’re clustered. And nowhere is this more obvious than in Sukhumvit. This central artery is now synonymous with luxury living and an international tenant base. Data shows that mid-Sukhumvit (Phrom Phong to Ekkamai) hosts 48 developments and 8,129 units, making it the city’s densest zone for serviced apartments.

下段Sukhumvit(Asoke至Ploenchit)则以26个项目、4135套单位紧随其后。不难理解为什么这两地如此受追捧:地铁BTS沿线、国际学校林立、周围餐厅、商场、医疗、娱乐一应俱全,无论是生活便利性,还是国际氛围,都形成了天然的“外籍人士吸附带”。很多旅客初来曼谷时选择这里,不是偶然,而是一种“精致生活半月包”的刚需体现。

Lower Sukhumvit (Asoke to Ploenchit) follows with 26 projects and 4,135 units. The reason is clear: BTS access, top-tier international schools, malls, hospitals, restaurants, and entertainment—all in one area. For expats, it’s a built-in ecosystem. Many choose Sukhumvit not by accident, but because it fits their vision of refined, effortless living—even if only for two weeks at a time.

◆ ◆ ◆ ◆

一房要价10万泰铢,哪些项目最赚钱?

One-Bedroom Units Near 100,000 Baht:

Which Projects Are Worth It?

◆ ◆ ◆ ◆

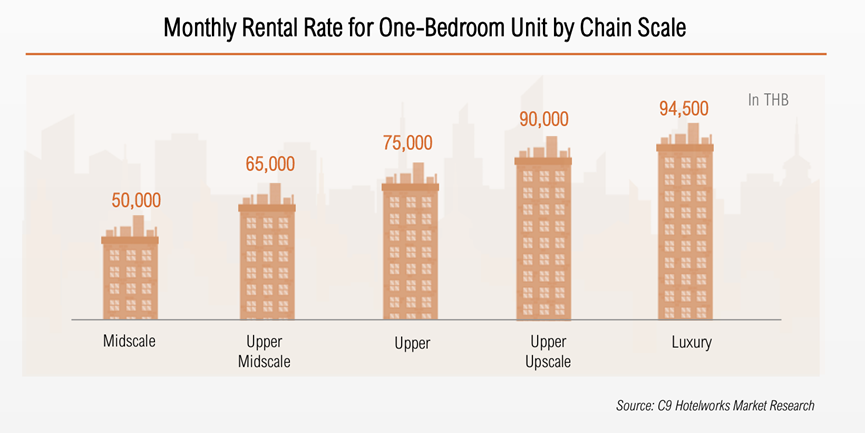

如果说Sukhumvit是曼谷的高端住宅心脏地带,那它的服务式公寓价格也确实配得上这个地位。根据C9 Hotelworks的市场统计,目前一居室月租从5万泰铢起跳,高端豪华产品更是接近9.5万泰铢,而这些价格,基本都包含了家政打扫、床品更换、水电全包等服务。

In Bangkok, Sukhumvit isn’t just the residential core—it’s where serviced apartment prices truly reflect premium status. According to C9 Hotelworks, one-bedroom units now start around 50,000 Baht per month, with high-end options nearing 95,000 Baht. These typically include housekeeping, linen changes, and all-in utility coverage.

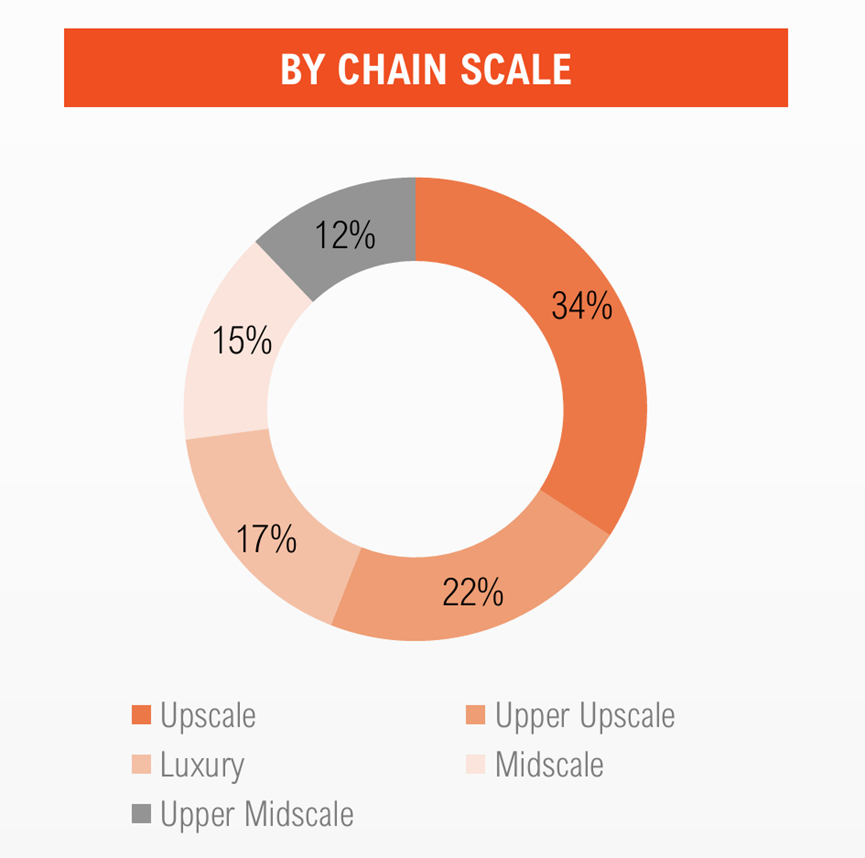

在市场构成上,高端(Upscale)与超高端(Upper Upscale)项目合计占比超过56%,而豪华级(Luxury)占了17%,大多分布在Siam、Ratchadamri等核心地段。

The market is dominated by upscale and upper-upscale properties, which account for more than 56% of total supply. Luxury projects make up another 17%, mainly in elite neighborhoods like Siam and Ratchadamri.

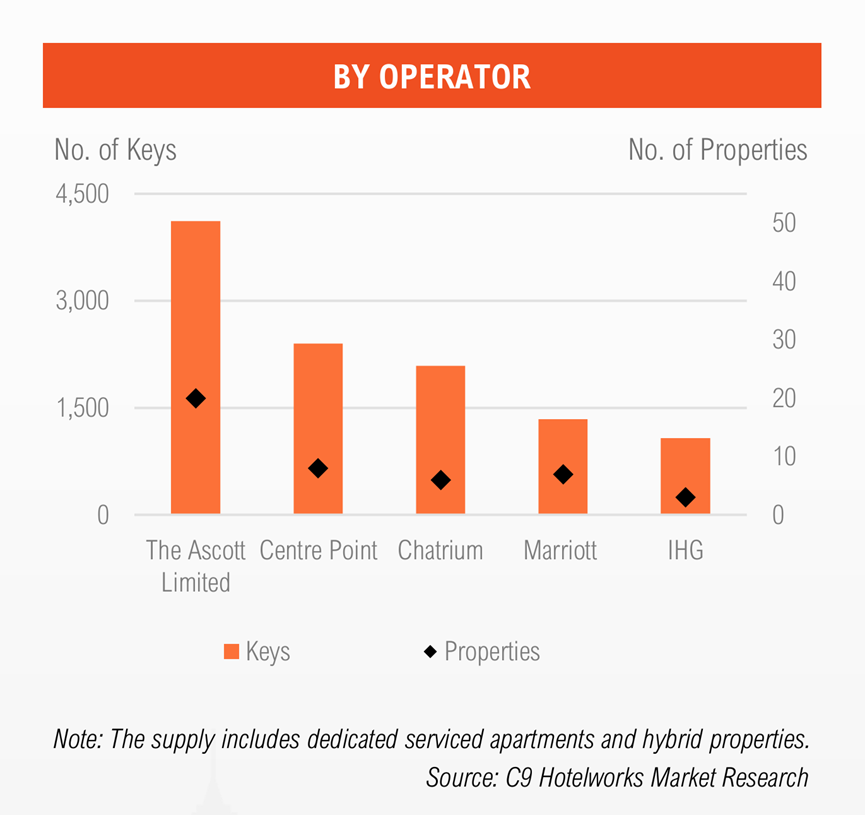

这些产品之所以能拉高租金上限,靠的不仅是地段和服务,更是背后的品牌溢价——像The Ascott Limited、Centre Point、Chatrium、Marriott等国际大牌,各自手握千套房源,牢牢锁定中高端短租市场的主动权。

What drives these rents beyond location and convenience is brand equity. Global hospitality giants—Ascott, Centre Point, Chatrium, Marriott—each manage thousands of units, securing firm control over the mid-to-premium short-term rental space.

从投资者角度来看,这种稳定的高租金回报与日趋专业化的运营方式,正是吸引资金持续入场的关键。

For investors, this means more than just high returns—it’s about entering a mature, professionally operated sector with predictable performance.

◆ ◆ ◆ ◆

接下来会涨还是跌?

What’s Next—A Boom or a Slowdown?

◆ ◆ ◆ ◆

服务式公寓的火,并不是一阵风吹热,而是有清晰的延续性。今年,曼谷还将迎来11个新项目、总计2319个新增房源,其中有超过一半集中在下Sukhumvit区域。

This isn’t a short-lived boom. The rise of Bangkok’s serviced apartments shows clear signs of sustainable growth. This year alone, the city will welcome 11 new projects totaling 2,319 units—more than half located in Lower Sukhumvit.

从项目形态上看,“酒店+公寓”的混合开发成为主流,比如即将开业的Radisson Hotel Ploenchit Bangkok、Hyatt House Sukhumvit 23,都采用了套房+服务式公寓的组合模型,迎合灵活租住需求。

The dominant format? Hybrid developments that blend hotels and serviced apartments. Projects like the upcoming Radisson Hotel Ploenchit Bangkok and Hyatt House Sukhumvit 23 are tailored for flexibility, combining full suites with hotel-grade services.

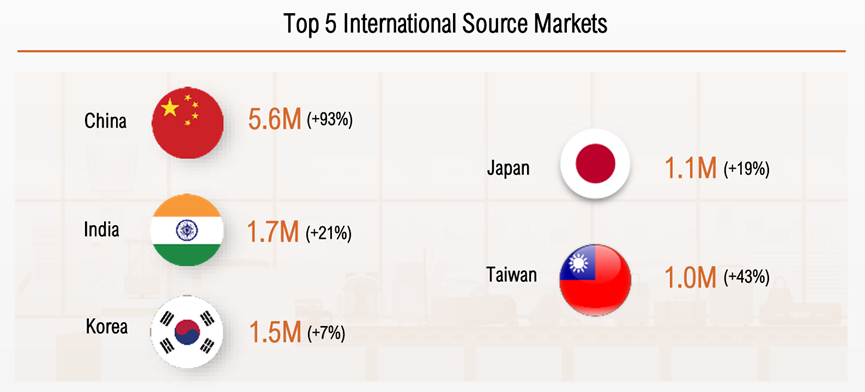

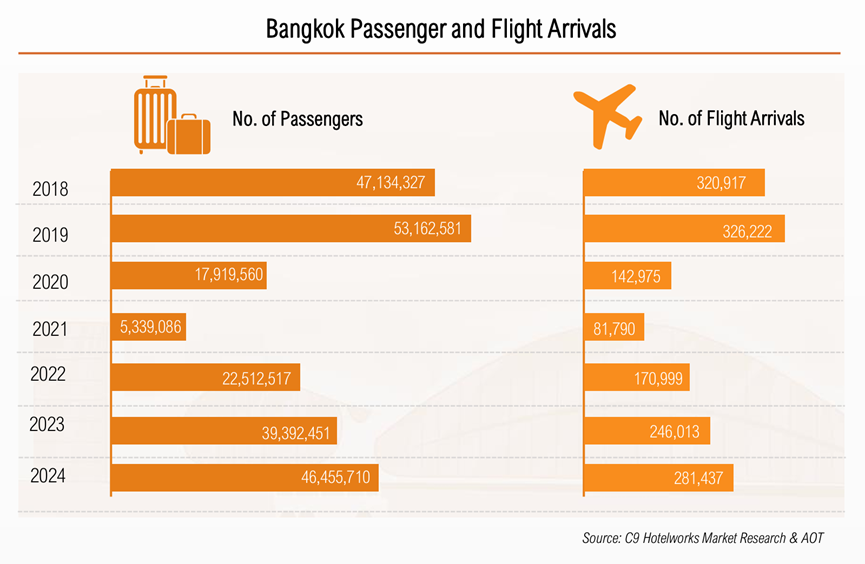

与此同时,城市两大机场的扩建、游客年增长超17%的趋势、以及国际大型节庆的加持,都在不断放大曼谷作为全球旅游枢纽的吸引力。

Other macro factors also boost confidence: expansion of both major airports, a forecasted 17% annual increase in tourists, and the return of global events are reinforcing Bangkok’s position as a world-class destination.

C9的报告中提到,虽然整体入住率略有下滑,但每间可出租房的收入(RevPAR)已经超过疫情前水平,这说明市场已逐步进入“提价换质”阶段。在一线国际品牌持续加码、旅客结构回归稳定的背景下,投资人正在押注的,不只是回报率,而是未来几年持续上涨的确定性。

According to C9’s report, while occupancy rates have softened slightly, revenue per available room (RevPAR) has already surpassed pre-pandemic levels—a strong indicator that the market is upgrading in both price and quality. With international brands expanding and demand stabilizing, investors are betting not just on yield, but on the certainty of multi-year capital appreciation.

如果你也正在关注曼谷的投资机会,或者想亲自体验一下“像家一样的短租生活”,可以扫码了解一下。作为专注于泰国本地市场的房产服务平台,我们不仅提供一手买卖项目的投资顾问服务,还能为你匹配合法合规的高品质短租公寓,让你无论是买来自住、投资出租,还是短期停留,都能轻松搞定。

Scan the QR code to learn more. As a platform specializing in the Thai property market, we offer expert consulting on primary sales, and match clients with high-quality, fully legal serviced apartments. Whether you’re buying to live in, rent out, or just stay short term, we make the process seamless.

点“阅读原文”了解更多