Thailand's Property Market in Freefall: Earthquakes, Tariff Hikes, and a Crisis of Confidence

◆ ◆ ◆ ◆

“黄金地段”的冷风吹

Cold Winds Blow Through “Prime Locations”

◆ ◆ ◆ ◆

过去几个月,泰国房地产市场的“寒意”开始从边缘蔓延到核心区域。哪怕是在往年一房难求的“黄金地段”,如今也开始出现看房者寥寥的冷清景象。政策刺激并不少——放宽LTV限制、减免转让和抵押费用,甚至央行也传出降息的信号,然而市场依然没能回暖。

In recent months, the chill in Thailand’s real estate market has spread from the periphery to its core. Even in previously high-demand “prime locations,” properties are now seeing sparse viewings and sluggish interest. Despite several stimulus efforts—easing loan-to-value (LTV) restrictions, reducing transfer and mortgage fees, and hints from the central bank about rate cuts—the market has failed to warm up.

房地产顾问公司Cushman & Wakefield的苏拉切特指出:“现在的问题不是有没有政策,而是没人敢出手。”金价持续飙升、经济前景扑朔迷离,加上全球局势动荡,普通民众对未来的不确定感比以往更强烈,他们更愿意把钱攥在手里,而不是砸进一套变现周期越来越长的房子里。即使是曾经抗跌的曼谷核心区,现在也在逐渐失去投资者和购房者的信心。

Surachet, a consultant with Cushman & Wakefield, remarked, “The issue isn’t whether policies exist—it’s that no one dares to act.” With gold prices soaring, economic prospects unclear, and global instability rising, ordinary people are more uncertain about the future than ever. They’d rather hold onto their cash than invest in properties that are increasingly difficult to resell. Even once-resilient central Bangkok is steadily losing the trust of investors and homebuyers alike.

◆ ◆ ◆ ◆

政策松绑也无力回天

Eased Policies Fall Short

◆ ◆ ◆ ◆

即便泰国政府不断释放利好消息,市场依然冷得彻骨。泰国银行在今年3月底放宽了贷款价值比(LTV)限制,从2025年5月1日延续至2026年6月底,意图激活更多首购与投资需求。紧接着,政府又于4月下调了总价700万泰铢以下房屋的转让税和抵押贷款费用,有效期也是长达两年。但现实是,这一系列“救市组合拳”并没有击中购房者的痛点。

Despite a stream of government support, the market remains frigid. At the end of March, the Bank of Thailand extended relaxed LTV ratios through June 2026, aiming to boost demand among first-time buyers and investors. In April, the government also reduced transfer and mortgage fees for properties priced below 7 million baht for a two-year period. However, this policy bundle failed to address buyers’ deeper concerns.

苏拉切特坦言,这些政策本质上只是“降低门槛”,而非“增强信心”。问题的核心不是买房贵,而是人们不敢动用手上的资金。尤其在美国关税上调、泰铢贬值预期加剧的背景下,经济越发不确定,消费者更倾向于保守消费,房产这种高价、长期的支出自然首当其冲。数据显示,今年第二季度市场成交量可能继续下滑,开发商原本寄望于政策触底反弹的希望,也逐渐转为观望甚至收缩。

Surachet bluntly noted that these measures merely “lower the entry barriers” but do not “restore confidence.” The real issue isn't high prices—it's that people are afraid to spend. With U.S. tariffs rising and a weakening baht raising uncertainty, economic prospects have become more fragile. Consumers are leaning toward conservative spending, and large, long-term purchases like real estate are naturally among the first to be delayed. Data suggests transaction volumes may continue to decline in the second quarter, and developers who were hoping for a rebound are instead retreating into caution—or outright scaling back.

◆ ◆ ◆ ◆

没人买,开发商也躺平了

Buyers Absent, Developers Retreating

◆ ◆ ◆ ◆

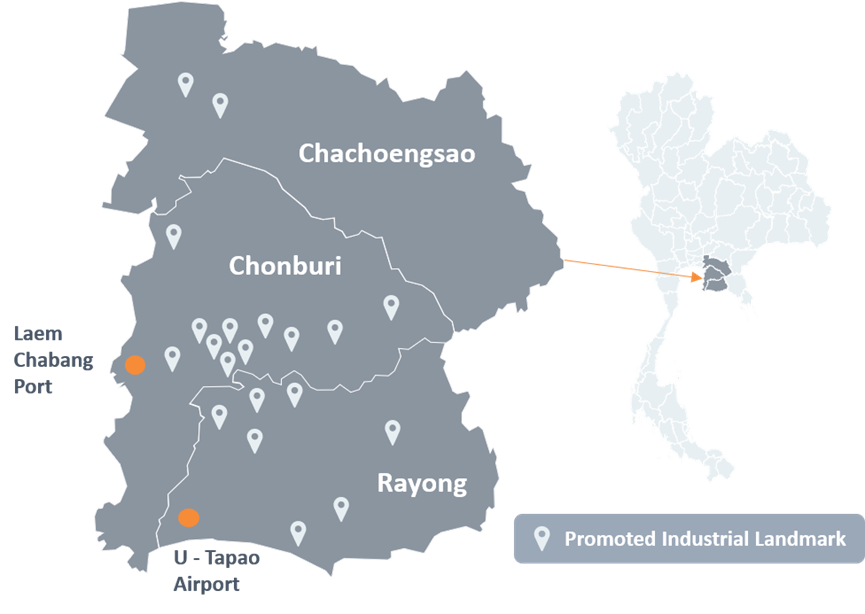

市场冷到什么程度?不仅买家不出手,连开发商也不再冒险了。在泰国东部曾一度火热的春武里、罗勇和北柳等省份,今年的住宅投资几乎陷入停滞。以春武里为例,当地房地产协会主席瓦塔那蓬透露,由于银行收紧信贷、购房者贷款审批频频遭拒,售价300万泰铢以下的房屋吸收率几乎为零——也就是说,价格已经压到最低了,还是没人接盘。

How bad is the market? Not only are buyers holding back—developers are now avoiding risk. In once-bustling eastern provinces like Chonburi, Rayong, and Chachoengsao, housing investments have nearly ground to a halt this year. In Chonburi, the local real estate association chairman, Wattana Phon, revealed that due to tightened bank credit and frequent loan rejections, homes priced under 3 million baht have virtually zero absorption rates. In other words, even rock-bottom prices aren’t attracting buyers.

开发商的应对策略异常现实:缩减新项目、暂停扩张、观望为主。他本人旗下的公司2024年只推出一个不足百户的小型住宅项目,而三年前,他们一年还能上马五六个、动辄上千户的项目。REIC发布的数据也印证了这股退潮:今年前几个月东部三省的住宅转让总量同比下降6.7%,总价值缩水近8%。而从2023年第三季度开始,住宅转让连续六个季度下滑,基本已经打破了过去“政策一出、成交即涨”的周期性规律。

Developers have adopted a highly pragmatic strategy: cutting new projects, halting expansion, and adopting a wait-and-see approach. Wattana Phon’s own company will only launch a single small-scale housing project in 2024—fewer than 100 units—compared to the five or six large-scale projects it launched annually just three years ago. Data from the Real Estate Information Center (REIC) backs this trend: residential property transfers in the three eastern provinces dropped 6.7% year-over-year in early 2024, with total value falling by nearly 8%. Transfers have declined for six consecutive quarters since Q3 2023, breaking the once-typical cycle of “policy stimulus equals transaction surge.”

更明显的是土地与建案的“未启动”状态:2024年低层住宅项目土地划拨数量暴跌超过四成,建筑许可面积减少15%以上。这些数字背后,是真金白银的退出和开发意愿的消失。当开发商集体踩下刹车,也就意味着他们对市场恢复的预期已不乐观。

More telling are the plunging figures for unstarted developments. In 2024, the number of land allocations for low-rise housing dropped over 40%, while permitted construction area fell by more than 15%. These numbers reflect the retreat of actual capital and a dramatic drop in developers’ willingness to invest. When developers collectively hit the brakes, it signals little optimism for recovery.

◆ ◆ ◆ ◆

外国人也不买了

Foreign Buyers Pulling Back

◆ ◆ ◆ ◆

曾经撑起泰国公寓市场半边天的外国买家,现在也在悄然退场。根据房地产信息中心(REIC)的数据,尽管2024年外国人购入的公寓单位数量相比去年略增0.86%,但总成交金额却暴跌了6.8%。换句话说,虽然“有人买”,但买得“更便宜”、“更谨慎”了,真正有购买力的大客户在撤退。

Foreign buyers—once a pillar of Thailand’s condo market—are also stepping away. According to REIC data, while the number of units purchased by foreigners in 2024 rose slightly by 0.86%, the total transaction value plunged by 6.8%. In other words, while some foreigners are still buying, they’re spending less and proceeding more cautiously. Major, high-spending investors are retreating.

最典型的例子就是中国买家。2024年,中国人仍然是泰国公寓市场的最大外资群体,占据了近四成的成交量和成交金额,但数量和金额都比上一年大幅缩水。而这个变化,并不是被其他国家填补的——缅甸和俄罗斯虽然排名上升,但交易总额远无法接棒。

Chinese buyers remain the largest foreign group, accounting for nearly 40% of condo transactions by both volume and value. However, both figures have declined sharply from the previous year. And this gap has not been filled by other nationalities—while Myanmar and Russia moved up in the rankings, their transaction volumes remain far too low to compensate.

信心下降背后的原因不难理解:美国提高全球关税、泰国本币汇率波动、东南亚整体风险增加,再加上中国和俄罗斯本国经济的不确定性,使得海外资产配置变得更加谨慎。而泰国本地的政策利好,也基本对外国投资者无感。更何况,曼谷和春武里这两个传统热门区域,如今的价格与风险已经不再成正比。

The decline in confidence is easy to understand: increased U.S. tariffs, baht volatility, rising Southeast Asian risk, and uncertainty in China and Russia have made overseas asset allocation more cautious. Thailand’s domestic incentives hold little appeal for foreign investors. And in key markets like Bangkok and Chonburi, prices are increasingly seen as unjustifiable relative to risk.

这还不是最糟的。数据显示,外国人购买的平均公寓面积变小、单价变低,“投资型购入”正被“保守型试探”所取代。一句话总结:外国人不是没来,而是不敢重仓了。

Worse still, foreign buyers are now choosing smaller units at lower prices, signaling a shift from investment-driven purchases to conservative, test-the-waters deals. Simply put, it’s not that foreigners are gone—they’re just not ready to commit in a big way anymore.

◆ ◆ ◆ ◆

地震之后,信任塌了

After the Earthquake, Trust Collapsed

◆ ◆ ◆ ◆

一场7.7级的地震,彻底撕开了泰国高层住宅市场的脆弱外壳。原本高层公寓是外资和本地中产最偏爱的置业类型,但地震发生后,买家的关注点发生了质变——价格不再是核心,结构安全和开发商的责任感成为决定因素。

A 7.7-magnitude earthquake has exposed the fragility of Thailand’s high-rise residential market. Previously the go-to choice for foreign buyers and local middle-class families, high-rise condos are now under intense scrutiny. Price is no longer the priority—structural safety and developer accountability now top the list.

房地产顾问公司高力国际的帕塔拉猜指出,这场突如其来的灾难正在重塑消费者的判断逻辑。过去大家只看户型、交通、配套,现在第一眼就想知道:楼抗几级?谁建的?有没有质保?反应快不快?危机之下,开发商被“重新评估”,迅速回应、组织结构检测、及时公示的品牌开始脱颖而出,而那些慢半拍、态度冷淡的企业则遭遇了口碑雪崩。

Patarachai, an analyst at Colliers International, notes that the quake has completely reshaped consumer logic. Buyers once focused on layout, location, and amenities; now they immediately ask: How earthquake-resistant is this building? Who built it? Is there a warranty? How fast was the developer’s response? Developers are being re-evaluated: those who acted quickly with inspections and public updates gained favor, while those who delayed or downplayed the issue suffered serious reputational damage.

这种信任断层直接反映在销售数字上。高力国际预计,2025年第二季度曼谷新公寓销售率可能会跌破30%,甚至低于疫情最严重时期的水平。这一次的下滑,已经不是“买不起”的问题,而是“买不下去”的犹豫和恐惧。更讽刺的是,在同一季度,曼谷新推出的公寓项目数量还同比大增七成,形成了鲜明的供需错位。

This breakdown in trust is already showing up in numbers. Colliers forecasts that Bangkok’s new condo sales rate may fall below 30% in Q2 2025—worse than during the height of the pandemic. This isn’t a case of “can’t afford to buy” anymore, but rather “too afraid to buy.” Ironically, in the same quarter, the number of new condo project launches in Bangkok is expected to surge by 70% year-over-year, highlighting a stark supply-demand mismatch.

对于买家来说,这不仅是对一套房的考量,而是对一整座城市居住安全系统的质疑。而对开发商而言,这场信任危机远比土地划拨减少或政策无效更棘手。因为它打击的,是最难重建的东西:信心。

For buyers, this is no longer just about choosing a property—it’s a questioning of the safety of the entire city. For developers, the trust crisis is more damaging than reduced land use or policy inefficacy, because it attacks the one thing hardest to rebuild: confidence.

◆ ◆ ◆ ◆

结语

Conclusion

◆ ◆ ◆ ◆

政策在努力,市场却在沉默。无论是外部的地震与关税,还是内部的信贷紧缩与消费信心崩塌,泰国房地产正在遭遇一场多线并发的系统性危机。从开发商退场,到买家观望,从外国资金撤离,到购房者对“安全感”的重新定义,这个市场正在经历一场不可逆的深度重构。

While policies continue to roll out, the market remains unresponsive. Thailand’s property sector is in the midst of a multi-front systemic crisis—earthquakes, rising tariffs, tightening credit, and a collapse in consumer and investor confidence. Developers are stepping back, buyers are hesitating, foreign capital is retreating, and the very definition of a “safe investment” is being challenged. The market is undergoing a deep and likely irreversible restructuring.

或许,有人还在等待下一个拐点,但现实是,所有人都在等待别人先出手。在信心回归之前,每一个新的利好都像一块投进冰水中的小石头——激不起浪,也传不出暖。

Some may still be waiting for the next turning point, but in reality, everyone is waiting for someone else to act first. Until confidence returns, each new policy measure is like a pebble thrown into icy water—raising no ripples and bringing no warmth.